[Updated on January 29, 2025 with screenshots from H&R Block Deluxe downloaded software for the 2024 tax year.]

A Mega Backdoor Roth is different from a regular Backdoor Roth. It’s done by making non-Roth after-tax contributions to a 401k-type plan before moving it to the Roth account within the 401k-type plan or taking the money out (with earnings) to a Roth IRA.

It’s a great way to put additional money into a Roth account without having to pay much additional tax. Not all plans allow non-Roth after-tax contributions but some estimated that 40% of people can do it.

Suppose you did a Mega Backdoor Roth last year. You should have received a 1099-R form from your 401k plan provider. You’ll need to account for it on your tax return. Here’s how to do it in H&R Block tax software. If you use TurboTax or FreeTaxUSA, please see:

Use H&R Block Download

The screenshots in this post are from H&R Block Deluxe downloaded software. The downloaded software is both less expensive and more powerful than the online version. A user reported getting an error from the online version of H&R Block in comment #8. The H&R Block downloaded software didn’t give that error.

If you haven’t paid for your H&R Block online filing yet, you can buy H&R Block downloaded software from Amazon, Walmart, Newegg, or Office Depot and switch to the downloaded software. If you’re already too far along with your entries, make this your last year of using the online version and switch to the downloaded version next year.

Within the Plan Or To Roth IRA

You can do the mega backdoor Roth in two ways — convert within the plan or withdraw to a Roth IRA. Converting within the plan is much easier, and many plans automate the process. Transferring to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA?

Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time you converted the money to the Roth account within the plan or transferred it to your Roth IRA, your contributions earned $200. You converted $10,200 to your Roth account.

I’m using 401(k) as a shorthand. It works the same in a 403(b). If you did a split rollover — after-tax contributions to a Roth IRA and the earnings to a Traditional IRA — and the plan administrator issued one 1099-R for your two rollovers, you’ll need to split your 1099-R into two. See One 1099-R Form for Two Rollovers in TurboTax and H&R Block.

1099-R Entries

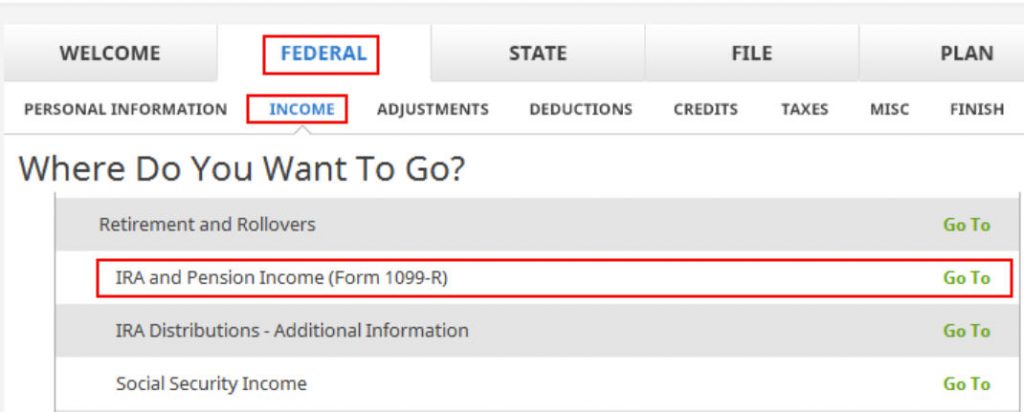

Go to Federal -> Income -> IRA and Pension Income (Form 1099-R). You can import the 1099-R or enter it manually. I’m showing manual entries.

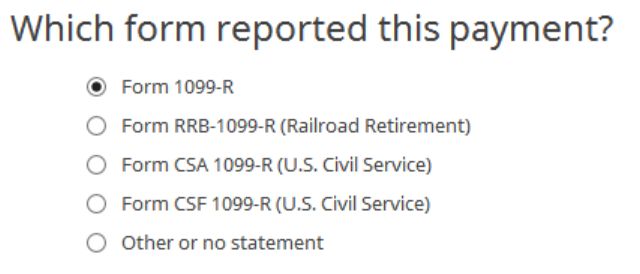

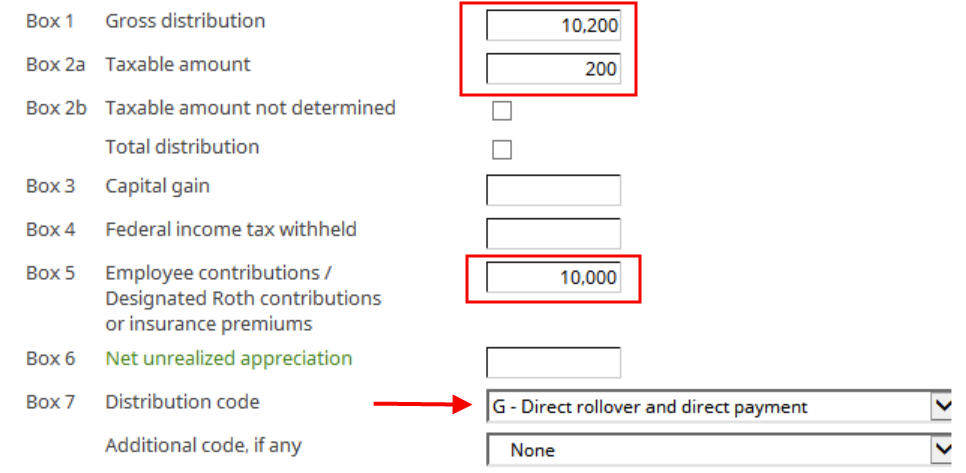

Our 1099-R is a normal 1099-R. Enter the numbers from your 1099-R as-is. Ours looks like this:

The gross amount converted to the Roth account shows up in Box 1. The earnings are in Box 2a. If you didn’t have earnings in your rollover, Box 2a is zero. “Taxable Amount Not Determined” under Box 2b is left unchecked. The amount of your non-Roth after-tax contributions shows in Box 5. Box 7 has code G.

The IRA/SEP/SIMPLE box in Box 7 on your 1099-R should NOT be checked.

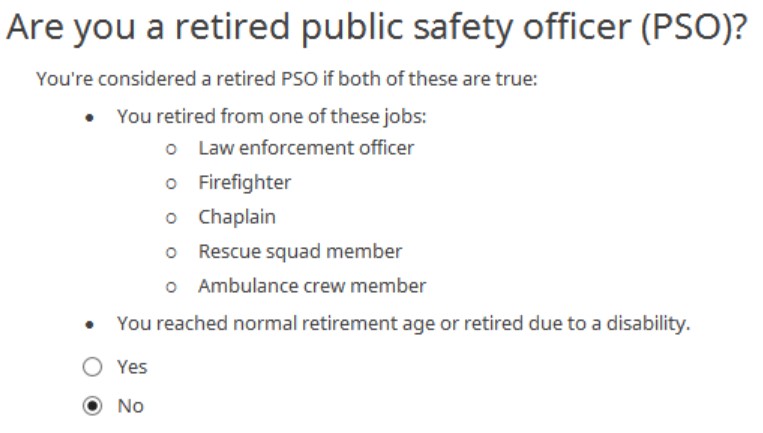

We’re not a retired public safety officer.

Rollover Destination

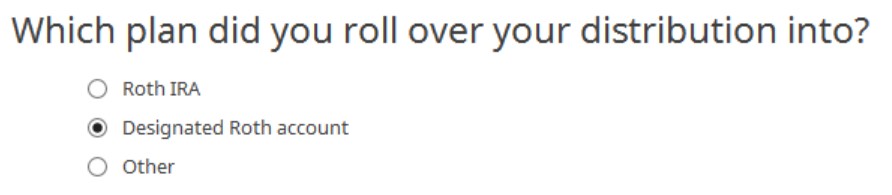

The Roth 401k account is officially a “designated Roth account” in the plan. Choose “Designated Roth account” if you converted within the plan. Choose “Roth IRA” if you took the money out of the plan to your Roth IRA.

That’s it. It’s as simple as that.

Verify on Form 1040

Now we verify we’re taxed only on the $200 in earnings, and not on the $10,000 non-Roth after-tax contributions.

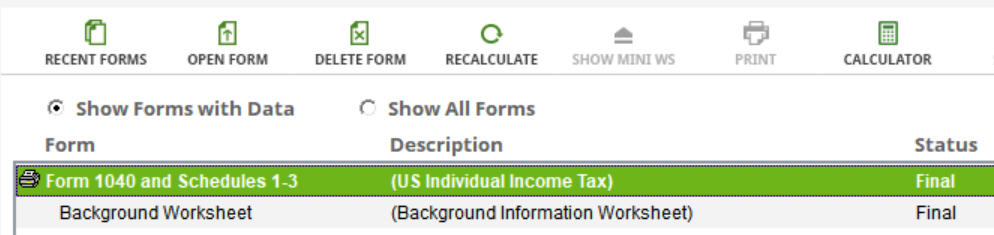

Click on “Forms” in the top menu bar. Double-click on “Form 1040 and Schedules 1-3” in the forms list and click on “Hide Mini WS.”

Scroll down to find Line 5. The gross amount transferred to the Roth account shows on Line 5a. Line 5b shows you’re taxed only on the earnings. If you didn’t have earnings, Line 5b will be zero.

When you’re done looking at the form, close the forms window to get back to the interview.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.